2024 401k Deferral Limit

2024 401k Deferral Limit. Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000. The contribution limit will increase from $22,500 in 2023 to $23,000.

The solo 401k contribution limits for 2024 have seen a significant jump to $69,000 and $76,500 for those aged 50 or older. 403(b), 401(k) or sarsep employee elective salary deferral limit limit applies to the total of pretax and roth 403(b) and 401(k).

Factors In That Decision About.

Older workers can defer paying income tax on as much.

November And December Are When They Choose How Much Of Next Year’s Salary To Defer Beyond The 401 (K) Limits.

Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most.

The Roth 401 (K) Contribution Limit For 2024 Is $23,000 For Employee Contributions And $69,000 Total For Both Employee And Employer Contributions.

Images References :

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2024. 2024 health savings account (hsa).

Source: www.jackiebeck.com

Source: www.jackiebeck.com

401(k) Contribution Limits for 2024, 2023, and Prior Years, 95 lakh per candidate for all states except arunachal. The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Source: choosegoldira.com

Source: choosegoldira.com

401k contribution limits 2022 Choosing Your Gold IRA, This year you will be able to save more for retirement than ever before with increased salary deferral contribution limits for employee retirement. The contribution limit will increase from $22,500 in 2023 to $23,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, 2024 tax brackets and standard deduction. Employers can contribute to employee roth 401 (k)s.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, The employee contribution limit for 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. The contribution limit will increase from $22,500 in 2023 to $23,000.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Irs Contribution Limits 401k Cammy Caressa, 2024 tax brackets and standard deduction. 95 lakh per candidate for all states except arunachal.

Source: pacpension.com

Source: pacpension.com

Lifting the Limits 401k Contribution Limits 2024, The roth 401 (k) contribution limit for 2024 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. 95 lakh per candidate for all states except arunachal.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, The roth 401 (k) contribution limit for 2024 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. 95 lakh per candidate for all states except arunachal.

Source: hoagsomematim.blogspot.com

Source: hoagsomematim.blogspot.com

at what age do you have to take minimum distribution from a 401k Hoag, Participants in simple 401 (k) and simple ira plans can take advantage of an increased deferral limit of $17,600 (i.e., 110% of the $16,000. This amount is up modestly from 2023, when.

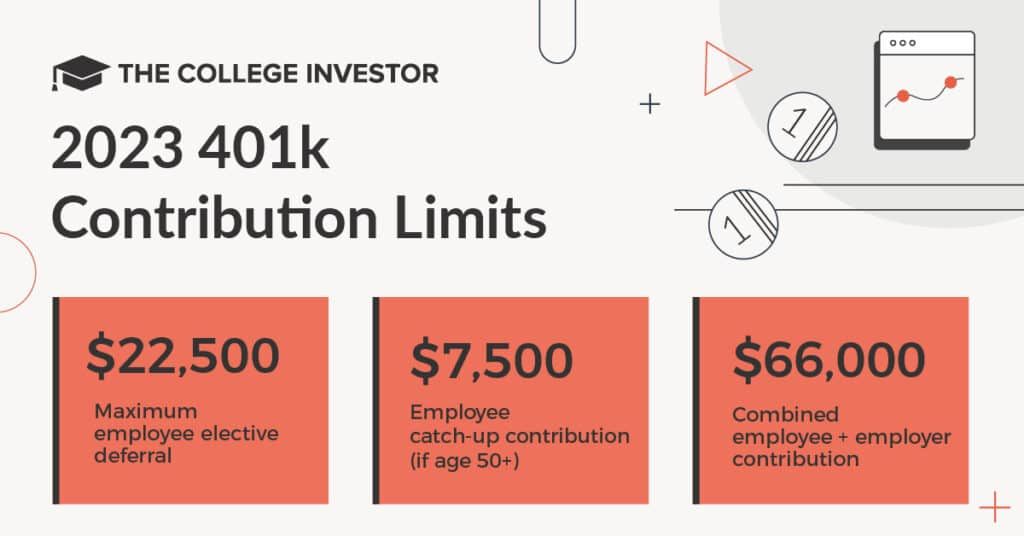

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

401k Contribution Limits For 2023, The following limits apply to retirement plans in 2024: Maximum employee elective deferral (for ages 49 and younger) $23,000:

Employers Can Contribute To Employee Roth 401 (K)S.

2024 401k limits contribution over 50.

Employees Age 50 Or Older May Contribute Up To An.

The basic limit on elective deferrals is $23,000 in 2024, $22,500 in 2023, $20,500 in 2022, $19,500 in 2020 and 2021, and $19,000 in 2019, or 100%.